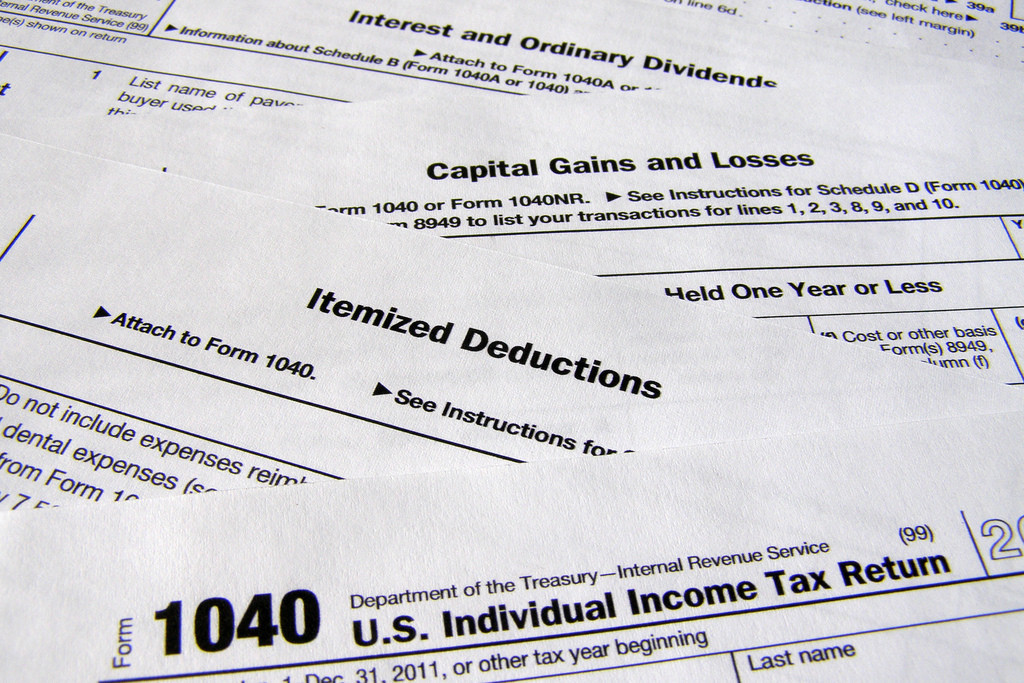

The 4 Layers of Investment Real Estate Tax

When an investor sells investment real estate, they face not just a single layer of taxation but several layers. That’s why Section 1031 is such a potent weapon. In total, taxpayers face up to four distinct layers of investment real estate tax. They come into play when taxpayer’s […]