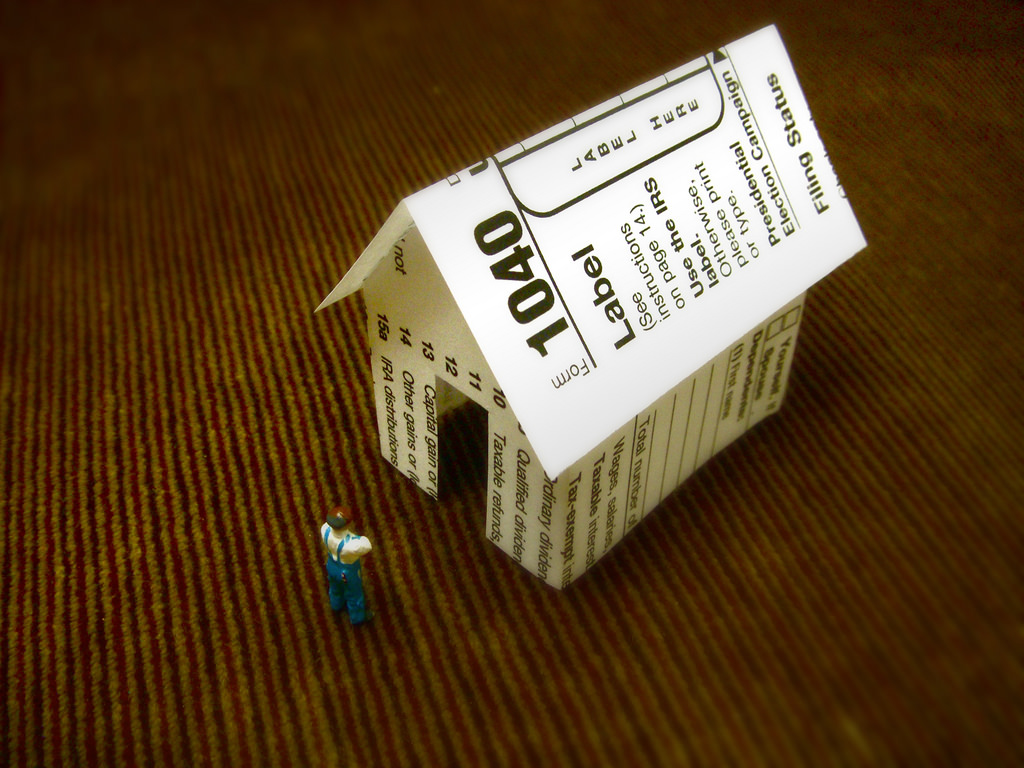

Is Cancellation of Debt Income?

Tax relief is a major part of our professional practice. It follows, then, that we should expend some ink going over what constitutes taxable income. One of the more confusing forms of taxable income is the phantom income known as cancellation of debt or, simply, COD income. It’s the source of many bewildered telephone calls to this law […]